The Investment Plan for Europe and Energy: making the Energy Union a reality

Energy efficiency, renewables, smart grids: with 24 financed projects and 29% of the available funding channelled into the energy sector, the Investment Plan For Europe is driving the Commission's goal of building an Energy Union forward.

From renovating buildings to make them energy efficient in France, to a new onshore wind farm in Sweden, 11 Member States have received support for sustainable, low-carbon projects which are in line with the EU's energy and climate goals. An additional €16.9 billion in investment is expected in sustainable and low-carbon energy projects over the coming years.

The Investment plan for Europe and the Energy Union are making change real, just one year after their launch. With key projects in energy infrastructure (in particular interconnections), renewable energy and energy efficiency, the financial cornerstone of the Investment Plan (EFSI, European Fund for Strategic investments)has allocated to the energy sector 29% of financing approved by the European Investment Bank (EIB). This adds up to the actions undertaken to leverage investments for small and medium enterprises (SME), in particular through the European Investment Fund (EIF), which has channelled EUR 3.5 billion for 185[1] SME financing agreements in the energy sector. Altogether, these operations in the energy sector are expected to have the knock-on effect of attracting additional investments of over EUR €16.9 billion in the coming years.

"The ambition to create an Energy Union is a priority for the Juncker Commission. The money we save on oil and gas imports and at the pump creates room for manoeuvre for intelligent, forward-looking investments in energy efficiency, renewables, innovation and modern energy infrastructure, all key objectives of the Energy Union. It also provides a window of opportunity to reduce and phase out fossil fuel subsidies", said theVice-President Jyrki Katainen.

"The Paris Climate Agreement has sent a clear message: the transition into a low carbon and climate-resilient economy is now irreversible. European industry is at the forefront, but when the market alone does not deliver the investments we need, then public money can be used wisely. We need to leverage private investments through public support, in particular when it comes to building interconnections and infrastructure, energy efficiency and renewable energy" added Climate Action and Energy Commissioner Miguel Arias Cañete.

Investing where it is needed

Energy efficiency projects are often fragmented and relatively small-scale. As a result, they generate high transaction costs for lenders, a relatively high risk-perception from financiers and unclear underlying business cases for the corporate world. These factors explain the current under-investment in energy efficiency projects. EFSI aims to make a difference to the availability of long-term financing for energy efficiency projects: it helps de-risk energy efficiency operations, up-scale existing financial instruments or create specific investment tools that enable a pooling of capital resources and bundling of investment projects into larger portfolios.

Bringing change in the real world

The 24 projects already funded are helping to achieve a carbon-free electricity sector. By 2030 half of all Europe's electricity will be powered by renewables and it will be carbon-free in about 35 years. A smart meters project in the UK, the construction of affordable energy efficiency housing units in France and the creation of an infrastructure investment fund to support financing for larger renewable energy projects, in wind, biomass and the transmission of electricity generated offshore in Denmark are expected to contribute to reaching the 2030 energy and climate goals, in line with the Paris Agreement.

Beyond financing

In addition to funding, the EU helps to make investments easier, more predictable and more attractive. Energy stakeholders, both from the public and the private sector, can benefit from technical assistance by registering a project to reach potential investors worldwide through the European Investment Project Portal (EIPP); up to now, more than one third of the submitted projects are energy-related, mostly in renewables sector, with Greece, Romania, Bulgaria and Lithuania as leading submitters. They can also make use of the advisory services of the European Investment Advisory Hub (EIAH), who is engaging proactively in energy efficiency as well as in emerging areas such as smart cities or electro-mobility; it devotes a particular attention to public-private partnerships and cross-border projects[2].

Making funding accessible

Opportunities to secure financingunder EFSI are available on the EIB website. Projects can be directly submitted by promoters to the EIB or to established investment platforms, such as "IF Tri en Nord-Pas-de-Calais", a regional investment platform in the North of France. Infrastructure and innovation projects can consult the dedicated EIB webpage.Small and medium enterprises can consult a dedicated EIF page SME Window implemented through the EIF.

Background

The Investment Plan for Europe is the European Commission's tool to kick-start sustainable growth in Europe. Its cornerstone, EFSI, supports investments and provides financing instruments for risky operations. It is an initiative launched jointly by the EIB, the EIF and the European Commission. The Investment Plan for Europe goes beyond EFSI, and provides other funding opportunities to the energy sector, such as: the European Energy Efficiency Fund (EEEF), an innovative public-private partnership dedicated to mitigating climate change through energy efficiency measures and renewables; the Private Finance for Energy Efficiency (PF4EE), a financial instrument funded by the EU through the LIFE programme and implemented via the EIB; the Connecting Europe Facility (CEF) for trans-European energy infrastructure projects; and the European Structural Investment Funds (ESIF), with a dedicated fund for energy efficiency.

More information

- Press release and FAQs on one year of Investment Plan for Europe:

- Communication Taking stock of the Investment Plan for Europe and next steps

- Projects approved for financing under the EFSI

- SME agreements approved for financing under the EFSI

- Latest EFSI figures including a break-down by sector and by country

[1] As of 19 May 2016

[2] /sites/emis/files/articles/3331/2016/1_en_act_part1_v11.pdf

Annex I

EFSI financing in the energy sector

(projects approved by EFSI Investment Board as of 24 May 2016)

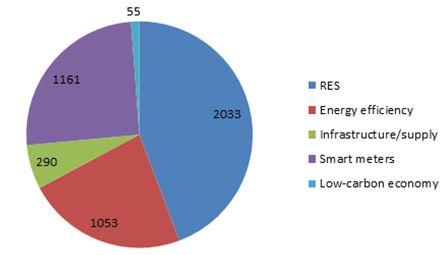

1. Share and value (in mln EUR) of EFSI investments in energy projects per sub-sector

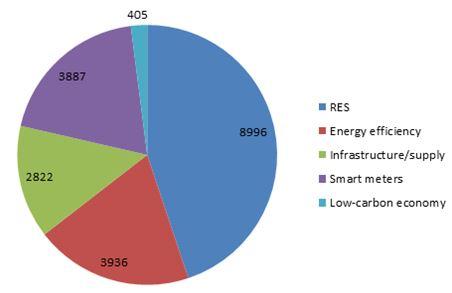

2. Share and value (in mln EUR) of the expected triggered investments per sub-sector

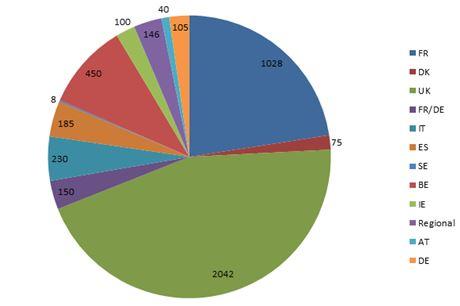

3. Share and value (in mln EUR) of EFSI investments in energy projects per Member State

Annex II

List of approved energy-related EFSI projects

|

All values in Million Euro |

Value of EFSI investment |

Sub-sector |

Value of expected triggered investment |

|

PROGRAMME EE FRENCH PRIVATE HOUSING (France) Energy efficiency renovation of residential buildings |

400 |

energy efficiency |

800 |

|

COPENHAGEN INFRASTRUCTURE II Project (DK) Infrastructure fund investing in larger renewable energy projects, with a focus on wind, biomass and offshore transmission. It is expected that at least 60% of the investments will be made in Germany and the UK |

75 |

Infrastructure/supply |

2100 |

|

REDEXIS GAS TRANSMISSION AND DISTRIBUTION Project (ES) Reinforcement and extension of the Redexis natural gas transmission and distribution network in several Spanish regions during the period 2015-2018 Redexis operates gas networks in the autonomous community of Aragon, Balearic Islands, Andalusia, Castile and Leon, Castile-La Mancha, Valencia, Madrid, Murcia, Catalonia and Extremadura |

160 |

Infrastructure/supply |

326 |

|

SMART METERS - SPARK project (UK) Modernising the metering systems in electricity and gas through the provision of smart meters |

461 |

smart meters |

1323 |

|

CAPENERGIE (France) Infrastructure fund targeting onshore wind, solar PV, hydro and district heating projects mainly in Western European countries |

50 |

RES |

1000 |

|

SAARLB – RE PROJECT FINANCE GUARANTEE (FR/DE) Risk-sharing facility for renewable energy (RE) projects in Germany and France |

150 |

RES |

300 |

|

GALLOPER OFFSHORE WIND Project (UK) Design, construction, and operation of a medium-scale offshore wind farm |

317 |

RES |

1638 |

|

RENEWABLE INCOME EUROPE (Ireland) Equity fund targeting investments in renewable energy projects in European OECD countries |

100 |

RES |

1000 |

|

IF TRI en Nord-Pas de Calais (France) Fund investing in enterprises developing low-carbon economy projects |

15 |

Low-carbon economy |

205 |

|

NOBELWIND OFFSHORE WIND (Belgium) Implementation of the second phase of a large-size offshore windfarm situated in the North Sea |

200 |

RES |

653 |

|

BEATRICE OFFSHORE project (UK) Design, construction, and operation of a large-scale offshore wind farm in UK |

714 |

RES |

2600 |

|

ENVO BIOGAS TONDER Project (DK) Construction and operation of a greenfield biogas production and biogas to methane upgrading facility in Denmark

|

33 |

RES |

93 |

|

RAFFINERIA DI MILAZZO project (IT) Various investments aimed at improving energy efficiency in an industrial plant and make it more environmentally-friendly |

30 |

Infrastructure/supply |

236 |

|

IMPAX CLIMATE PROPERTY FUND (UK) Investment in a private equity infrastructure fund targeting improvements in energy efficiency in UK commercial property |

25 |

energy efficiency |

500 |

|

RETE GAS SMART METERING (IT) Rollout of smart gas meters in Italy |

200 |

Smart meters |

415 |

|

MIROVA EUROFIDEME 3 CO-INVESTMENT WIND (SE) Construction and operation of an onshore wind farm in Sweden |

8 |

RES |

38 |

|

LOGEMENTS INTERMEDIAIRES-SLI (FR) Construction of 13,000 affordable housing units in France by the Société pour le Logement Intermédiaire (SLI) |

500 |

energy efficiency |

2300 |

|

ENERGIEPARK BRUCK ONSHORE WIND (AT) Construction and operation of 3 wind farms in Lower Austria and in Burgenland (Austria), respectively |

40 |

RES |

74 |

|

COMBINED HEAT AND POWER PLANT KIEL (DE) The project concerns the construction of a 188 MWe / 192 MWth natural gas-fired heat and power plant (“CHP”) in Kiel (Germany) |

105 |

energy efficiency |

278 |

|

QUAERO EUROPEAN INFRASTRUCTURE FUND (FR) The Fund aims at investing in different sectors including transport, education, telecommunications, utilities and renewable energy. Investments will be made mainly in greenfield (primary opportunities with short construction period) but also brownfield projects (secondary market) |

40 |

Low-carbon economy |

200 |

|

ODEWALD RENEWABLE ENERGY INFRASTRUCTURE FUND (Regional) Equity fund investing in small and midsize solar PV, onshore wind and hydro projects |

80 |

RES |

400 |

|

SUSI RENEWABLE ENERGY FUND II (Regional) Equity fund investing primarily in solar PV and on-shore wind projects mainly in the EU |

66 |

RES |

400 |

Source: © European Union, 1995-2016